Congress Should Restore Full Interest Deductibility in the Tax Code

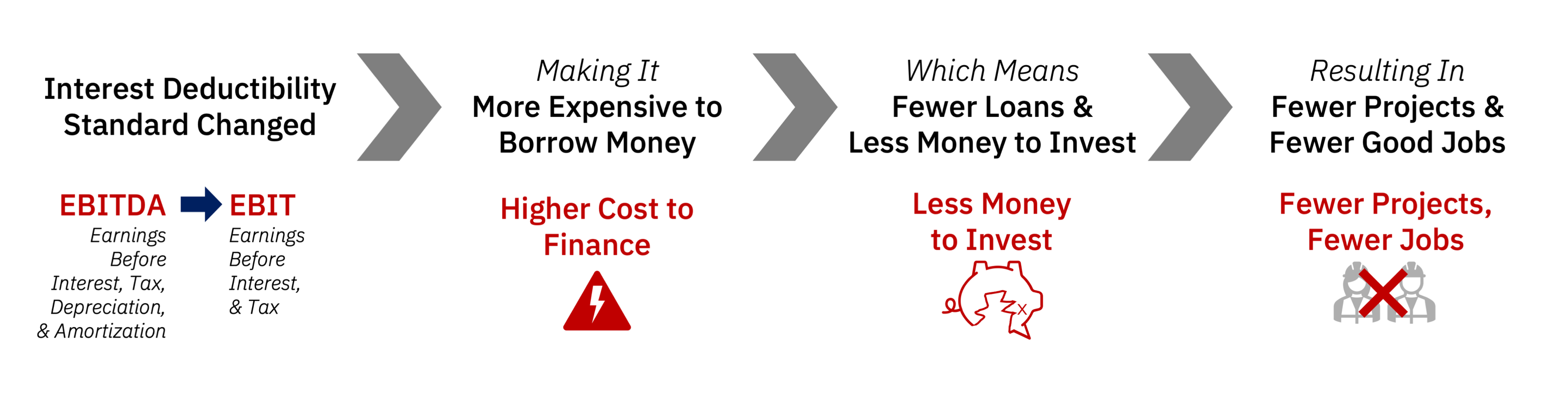

Lawmakers are getting closer to the finish line with budget reconciliation. Extension of the expiring provisions of the Tax Cuts and Jobs Act (TCJA) remains paramount. With a unique opportunity to continue to simplify the tax code and embrace pro-growth reforms, the expansion of interest deductibility for businesses is a key step in this process.

![NCTA-Logo-Tag-RGB[1]](https://restoreinvestment.org/wp-content/uploads/elementor/thumbs/NCTA-Logo-Tag-RGB1-r1p3op103iauv1fpzxjncopqe8hh5sywegt54um5p4.png)